Are you a business owner wondering how to calculate sales tax for your products or services? Whether you’re selling physical products or offering a service, it’s essential to understand the basics of sales tax.

Sales tax is a tax levied by the government on the sale of goods and services, and it varies by state and locality.

To calculate sales tax correctly, you need to know the tax rate in your state and locality and how it applies to your business. This can seem overwhelming at first, but with a little bit of knowledge and preparation, you can ensure that you’re charging the correct amount of sales tax and staying compliant with tax regulations.

In this article, we’ll break down the different types of sales tax, how to determine the tax rate, and how to add sales tax to your product or service costs. By the end of this article, you’ll have a better understanding of how to calculate sales tax for your business and stay on top of your tax obligations.

Understanding Sales Tax Basics

Understanding the ins and outs of sales tax is essential for any business owner looking to maximize profits and avoid legal complications. Sales tax is a percentage-based fee that is imposed on the sale of goods and services by the government. As a business owner, it is your responsibility to collect and remit sales tax to the government. Failure to do so can result in hefty fines and legal troubles.

One of the most important things to understand about sales tax is the concept of sales tax exemptions. Certain items or services are exempt from sales tax in some states, such as groceries or medical services. However, it is important to note that sales tax exemptions can vary greatly from state to state. Another common mistake business owners make is not registering for a sales tax permit. Without a permit, you cannot legally collect and remit sales tax, which can result in penalties and legal troubles.

Understanding the basics of sales tax is just the first step in calculating sales tax for your business. The next step is to understand the different types of sales tax, such as state and local sales taxes, and how they apply to your business. By keeping up-to-date with sales tax regulations and avoiding common mistakes, you can ensure that your business stays on the right track and avoids any legal complications.

Types of Sales Tax

There are various types of taxes that shoppers pay when purchasing products or services. As a business owner, it’s essential to know the different types of sales tax to ensure that you’re complying with the law. Sales tax is generally imposed by state and local governments, and the rates vary depending on the location.

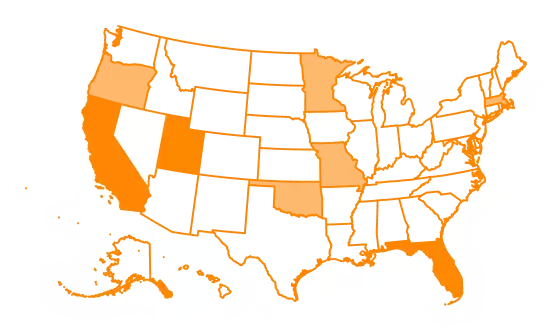

To help you understand the different types of sales tax, here’s a table that shows the states that have nexus requirements, exempt sales categories, and states that don’t have sales tax.

It’s important to note that some states have nexus requirements, which means that a business must collect and remit sales tax if they have a physical presence in that state. Additionally, there are exempt sales categories, such as food, medicine, and education, which are not subject to sales tax.

Understanding the different types of sales tax is crucial in calculating the correct amount of sales tax for your business. In the next section, we’ll discuss how to determine the tax rate for your sales.

Determining the Tax Rate

To figure out the tax rate for your sales, you’ll need to take into account the location of your business and the destination of the product or service, as the adage goes, “All politics is local.”Tax rates vary from state to state and even from county to county, so it’s important to research the specific regulations in your area. Some states have multiple sales tax rates depending on the product or service being sold, so it’s essential to be aware of any exemptions or special rules.

In addition to state-specific regulations, there may be exemptions or special rules that apply to your business. For example, some states exempt certain items like groceries or clothing from sales tax, while others may require a tax on all sales. It’s crucial to understand these exemptions and rules to ensure that you’re collecting the correct amount of tax and avoiding any penalties or fines.

Once you’ve determined the tax rate for your sales, you’ll need to add it to the cost of your product or service. This can be done in a variety of ways, such as including the tax in the listed price or adding it as a separate line item. Understanding how to calculate and apply sales tax is essential for any business owner, as it ensures compliance with regulations and accurate financial reporting.

Adding Sales Tax to Product or Service Costs

When you sell a product or service, don’t forget to factor in the sales tax – it’s an important cost to consider! Adding sales tax to your product or service cost is relatively simple. Here are some steps you can take to ensure that you’re properly factoring in sales tax:

- Calculate the sales tax rate for your business location: Before you can add sales tax to your product or service cost, you’ll need to know the current sales tax rate for your location. This information can typically be found on your state’s department of revenue website.

- Determine whether your business is exempt from sales tax: Depending on the nature of your business, you may be exempt from collecting sales tax. For example, if you sell items that are typically exempt from sales tax, such as food, you may not be required to collect sales tax on those items. It’s important to check with your state’s department of revenue to determine whether your business qualifies for any exemptions.

- Factor in special circumstances: In some cases, you may need to factor in special circumstances when calculating sales tax. For example, if you’re selling a product or service to a customer in a different state, you’ll need to determine whether that state has a different sales tax rate. You may also need to factor in any local sales tax rates if your business operates in an area with a higher sales tax rate than the state average.

By following these steps, you can ensure that you’re accurately calculating sales tax for your business. Once you’ve factored in sales tax to your product or service cost, you’ll need to stay compliant with tax regulations to avoid any legal issues. This involves keeping accurate records of all sales and taxes collected, and filing your taxes on time.

Staying Compliant with Tax Regulations

Make sure you’re following all tax regulations by keeping accurate records of every sale and timely filing your taxes, so you can avoid any legal issues and focus on growing your business. Tax compliance is a crucial aspect of running a business, and it involves staying up-to-date with the latest tax laws and regulations. One way to ensure tax compliance is by investing in tax compliance software, which can help you keep track of all your sales and expenses and generate accurate tax reports.

Tax compliance software can also help you prepare for a tax audit by providing you with the necessary documentation and reports. It can help you identify any discrepancies or errors in your sales and expenses, and ensure that you have all the necessary documentation to prove your compliance with tax regulations. With tax compliance software, you can rest assured that you’re always in compliance with tax laws and regulations, and that you’re prepared for any potential tax audits.

In addition to tax compliance software, it’s important to prepare for tax audits by keeping detailed records of all your sales and expenses. This includes keeping invoices, receipts, and other documentation for every transaction. By keeping accurate records, you can easily prove your compliance with tax regulations and avoid any legal issues. Overall, staying compliant with tax regulations is essential for the success of your business, and investing in tax compliance software and keeping accurate records can help you achieve this goal.

Frequently Asked Questions

Are there any exemptions or exclusions to sales tax that my business may qualify for?

Your business may qualify for sales tax exemptions based on certain criteria, such as the type of product or service you offer. However, be aware that sales tax audits may occur to ensure compliance. For example, a restaurant may be exempt from sales tax on food items, but not on alcohol sales.

How often do I need to file and remit sales tax to the government?

You must file and remit sales tax to the government according to the frequency requirements of your state. Late penalties may apply if you miss the deadline. Check with your state for specific guidelines.

What happens if I fail to collect or remit sales tax correctly?

If there are errors in collecting or remitting sales tax, penalties and audits may follow. Euphemistically speaking, it’s best to avoid such unpleasantness by staying up to date on your tax obligations.

Can I use software or tools to help me calculate and track sales tax for my business?

Sales tax software and tax tracking tools make it easy to calculate and track sales tax for your business. These tools automate the process and ensure accuracy, saving you time and reducing the risk of errors or penalties.

How do I handle sales tax for online sales to customers in different states or countries?

As you expand your business online, sales tax nexus becomes crucial. To handle cross border transactions, research the tax laws of each state or country, and use software that automatically calculates and tracks sales tax for you. Remember: failing to plan is planning to fail.

Conclusion

Congratulations! You now have a solid understanding of how to calculate sales tax for your business. By following the steps outlined in this article, you’ll be able to accurately determine the appropriate tax rate for your products or services and stay compliant with tax regulations.

But, you may still be hesitant to tackle this task on your own. You might be thinking, “I don’t have the time or knowledge to stay on top of all the tax rules and regulations. “It’s understandable to feel overwhelmed, but don’t let that hold you back from taking control of your finances.

Consider hiring a tax professional or investing in a reliable accounting software to ease the burden. The peace of mind that comes with knowing you’re staying compliant and avoiding costly penalties is priceless. Don’t let the fear of taxes hold you back from growing your business. Take charge and ensure your business is on the path to success.

| Nexus Requirements | Exempt Sales Categories | No Sales Tax |

|---|---|---|

| Alabama | Food | Alaska |

| Arizona | Medicine | Delaware |

| California | Clothing | Montana |

| Colorado | Agriculture | New Hampshire |

| Connecticut | Education | Oregon |

| Florida | Prescription drugs | |

| Georgia | ||

| Hawaii | ||

| Idaho | ||

| Illinois | ||

| Indiana | ||

| Iowa | ||

| Kansas | ||

| Kentucky | ||

| Louisiana | ||

| Maine | ||

| Maryland | ||

| Massachusetts | ||

| Michigan | ||

| Minnesota | ||

| Mississippi | ||

| Missouri | ||

| Nebraska | ||

| Nevada | ||

| New Jersey | ||

| New Mexico | ||

| New York | ||

| North Carolina | ||

| North Dakota | ||

| Ohio | ||

| Oklahoma | ||

| Pennsylvania | ||

| Rhode Island | ||

| South Carolina | ||

| South Dakota | ||

| Tennessee | ||

| Texas | ||

| Utah | ||

| Vermont | ||

| Virginia | ||

| Washington | ||

| West Virginia | ||

| Wisconsin | ||

| Wyoming |