Sales Tax Services

Impericom’s sales tax service provides businesses with the expertise and support they need to stay compliant with state sales tax laws and regulations. Our team of professionals can help ensure that sales tax is collected and reported correctly, minimizing the risk of penalties and fines.

Did you know? Impericom sales tax services picks up Sales Tax where Avalera leaves off.

Got Nexus? Registering, Filing, Collecting, Calculating – Sales Tax is never easy alone.

The Helpful Guidebook To State Sales Tax Registration

Registering for a sales tax permits is a necessary pain. This is how to get sales tax registration right the first time.

Not Remitting Sales Tax? Avoid These Consequences!

Learn the costly consequences of not collecting or remitting sales tax. Don’t get caught! Read now.

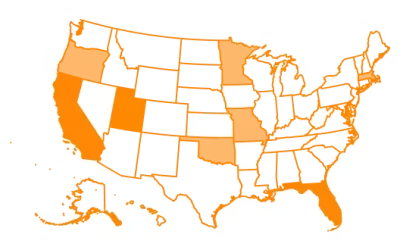

Sales Tax for Remote Sellers

Remote Sellers, navigate sales tax laws and avoid costly penalties when selling products across state lines. Get expert tips from Impericom LLC!

How Do I Calculate Sales Tax For My Online Business?

Learn how to calculate sales tax for your business in minutes! Our step-by-step guide makes it easy. Click now!

Sales Tax Services

Special limited time offer. Get a 15 min dicovery call for free.

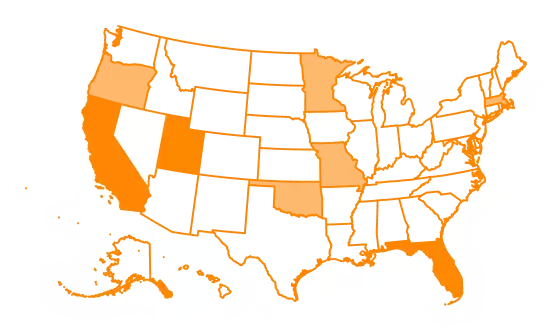

How Impericom LLC fulfills 8 Sales Tax requirements every retailer must face.

- Registration: Impericom registers the business with the state’s tax department to obtain a sales tax permit and any other required licenses.

- Determination of Taxability: Impericom determines which products or services are subject to sales tax in the state, and which are exempt.

- Collection of Tax: Impericom sets up systems to collect sales tax from customers at the time of sale, and ensures that the correct amount of tax is collected based on the products or services being sold and the location of the sale.

- Reporting and Remitting Tax: Impericom tracks and reports sales tax collected to the state’s tax department, and remits the collected tax to the state on a regular basis (usually monthly or quarterly)

- Record Keeping: Impericom keeps accurate records of all sales tax collected and remitted, including sales invoices, receipts and other documents, to ensure compliance with state regulations

- Staying Current: Impericom stays current with changes in state sales tax laws and regulations, and updates their systems and procedures as necessary to ensure ongoing compliance.

- Filing Returns: Impericom files the sales tax returns on behalf of the client, ensuring that all the information is accurate and complete.

- Representation: In case of any audit or inspection from the state, Impericom represents the client and provides the necessary documents and information.